When a drug’s patent expires, something dramatic happens: prices don’t just dip-they collapse. For patients paying hundreds a month for a prescription, that moment can mean the difference between affording treatment and skipping doses. It’s not magic. It’s economics. And it’s happening right now with drugs like Eliquis, Humira, and Ozempic.

Why patents matter-until they don’t

Pharmaceutical companies spend years and billions developing a new drug. To recoup that investment, they get a 20-year patent. During that time, they’re the only ones allowed to sell it. That’s the deal: innovation rewarded with monopoly pricing. But once the patent runs out, the rules change. Suddenly, any company can make a copy. And they do. Fast. The first generic version usually hits the market within months. Prices drop 15% to 20% right away. Not bad. But that’s just the beginning. By the time five or six generic makers are selling the same pill, prices can plunge 80% or more. In the U.S., a drug like Eliquis (apixaban) cost $850 a month as a brand name. After generics arrived in 2020, the same dose dropped to $10. That’s not a sale. That’s a revolution.It’s not one generic-it’s a flood

The real price crash doesn’t come from one competitor. It comes from the third, fourth, and fifth. Each new generic manufacturer brings down the price a little more. They’re not trying to make a fortune. They’re trying to get a slice of a market that just opened up. And they’ll undercut each other to do it. A 2023 study in JAMA Health Forum looked at 505 drugs across eight countries. In the U.S., prices fell 82% over eight years after patent expiration. In Germany, it was 58%. In Switzerland, only 18%. Why the difference? It’s not about the drug. It’s about the system. The U.S. has no central price control. Pharmacies and insurers negotiate directly. When generics flood in, they compete on price-and win. In Europe, governments set price caps based on what other countries pay. That slows the drop but makes it steadier. In the U.S., the drop is sharp. In Europe, it’s slow but sure.The Humira paradox: patents that won’t die

Not every drug follows the script. Humira (adalimumab), a blockbuster rheumatoid arthritis drug, had its main patent expire in 2016. But prices didn’t crash. Why? AbbVie, the maker, filed over 130 secondary patents. Some on minor changes to the delivery device. Others on how it’s used. These aren’t new drugs. They’re legal loopholes. This is called “patent thickets.” It’s not fraud. It’s strategy. And it works. Humira kept near-monopoly pricing until 2023-seven years after its main patent expired. That’s when Amgen and other companies finally launched biosimilars. Even then, prices didn’t fall as fast as expected. Why? Insurance rebates. Some payers still get kickbacks from AbbVie to keep Humira on their list. So patients don’t see the savings-even when cheaper versions are available. The same thing happened with Eliquis and Ozempic. Their base patents expired in 2020 and 2026 respectively. But dozens of secondary patents are still blocking full competition. I-MAK, a drug policy group, found that the average blockbuster drug gets 10 to 15 extra patents. That extends exclusivity by 12 to 14 years beyond the original term.

Who wins? Who loses?

Patients win when prices drop. A 2023 Kaiser Family Foundation survey found 68% of insured adults paid less when generics arrived. For those on Medicare or without insurance, the savings can be life-changing. Insurers and government programs win too. The Congressional Budget Office estimates generic and biosimilar competition will save the U.S. healthcare system $1.7 trillion over the next decade. That’s money that can go to other treatments, hospitals, or lower premiums. But originator companies? They lose revenue. That’s why they fight. They shift focus to new drugs. They lobby. They extend patents. They make deals with insurers to keep their brand on formularies. And they charge more for new versions-like once-weekly Ozempic versus daily versions-just to keep the cash flowing.Why some drugs take longer to get cheap

Not all drugs are created equal. Small molecule pills? Easy to copy. The FDA approves them in about 10 months. Complex biologics? Injectable drugs made from living cells? Harder. These require expensive bioequivalence studies-$2 million to $5 million per product. Approval can take two years or more. That’s why biosimilars (the generic version of biologics) are slower to arrive. Even when patents expire, the legal process-the “patent dance”-can delay entry by 2 to 4 years. And state laws on substitution vary. In some places, pharmacists can swap a brand for a biosimilar automatically. In others, the doctor must specifically approve it. Then there’s the supply chain. Making the active ingredient for a complex drug isn’t easy. Only a few factories in the world can do it. If one runs into trouble, the whole market stalls.

What’s changing now?

Regulators are waking up. In 2023, the U.S. Patent Office started cracking down on obvious secondary patents. The European Commission proposed limits on extended patent terms. The FDA approved 870 generic drugs in 2023-12% more than the year before. The Inflation Reduction Act also changed the game. Medicare can now negotiate prices for some high-cost drugs. That’s a threat to drugmakers. So some are timing their generic launches to avoid triggering those negotiations. It’s chess, not checkers. Meanwhile, the global generic drug market is growing fast-projected to hit $700 billion by 2030. That’s not just a business opportunity. It’s a public health win.What patients should know

If you’re on a brand-name drug, check its patent status. If it’s expired, ask your pharmacist: “Is there a generic?” Don’t assume your insurance will switch you over. Sometimes, you need to ask. If your copay didn’t drop after generics arrived, ask why. Is it a rebate deal? A formulary restriction? Your doctor can often write a new prescription that forces a switch. And if you’re paying $500 a month for a drug that’s now $20 in generic form? You’re not alone. But you’re not stuck. Ask. Push. Advocate. The system isn’t perfect. Patent thickets delay savings. Rebates hide discounts. But the core truth remains: patent expiration drives the biggest price drops in medicine. And when it happens, it’s not just a market shift-it’s a lifeline.What happens to drug prices when a patent expires?

When a drug’s patent expires, generic manufacturers can legally produce and sell the same medication. Prices typically drop 15-20% with the first generic, and can fall 80% or more once five or more competitors enter the market. The largest price drops occur in the U.S., where competition is less regulated and insurers negotiate directly with suppliers.

Why don’t all drugs get cheaper right away after patent expiration?

Some companies use ‘patent thickets’-filing dozens of secondary patents on minor changes-to delay generic entry. Complex drugs like biologics also take longer to copy due to high manufacturing costs and regulatory hurdles. Even after generics launch, insurance rebates or formulary restrictions can keep branded drugs on top, hiding savings from patients.

How long does it take for generics to appear after a patent expires?

In the U.S., the average time for the first generic to enter the market is about 30 months after patent expiration, though some arrive sooner. In Europe, generics typically launch within 12-18 months. For complex biologics, delays of 2-4 years are common due to legal battles and manufacturing challenges.

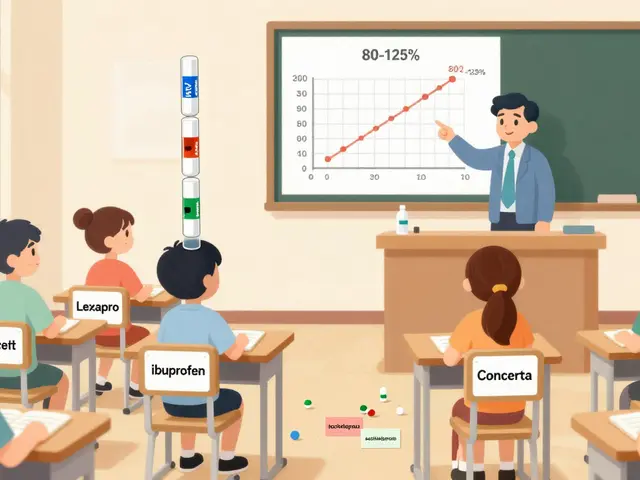

Are generic drugs as safe and effective as brand-name drugs?

Yes. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand-name drug. They must also prove they’re bioequivalent-meaning they work the same way in the body. Over 90% of U.S. prescriptions are filled with generics, and they’re used safely every day.

Can I ask my pharmacist to switch me to a generic?

Yes, in 49 U.S. states, pharmacists can substitute a generic for a brand-name drug unless the doctor specifically writes “dispense as written.” Even if your prescription doesn’t say that, you can still ask your pharmacist if a generic is available and if your insurance covers it. You might save hundreds a month.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule pills. Biosimilars are highly similar-but not identical-to complex biologic drugs made from living cells. Because biologics are harder to replicate, biosimilars require more testing and cost more to develop. They’re not called generics, but they serve the same purpose: lowering prices after patent expiration.

Why are drug prices still high in some countries after patent expiration?

Countries like Switzerland and Japan have systems that limit price competition. They use reference pricing, where the government sets prices based on what other countries pay, or negotiate bulk deals with manufacturers. These systems protect company profits but slow down price drops. The U.S. sees the steepest declines because its market is more fragmented and competitive.

Will the prices of Ozempic and Wegovy drop soon?

The base patent for semaglutide (the active ingredient in Ozempic and Wegovy) expires in 2026. But Novo Nordisk has filed over 140 patents covering delivery devices, dosing schedules, and formulations. These could delay generic competition until 2036. Without regulatory reform, meaningful price drops may not come for another decade.

9 Comments

Willie Onst

December 13, 2025 AT 04:07 AM

Honestly? This is one of those rare moments where capitalism does something good for people. I used to skip my Ozempic doses because it cost more than my rent. Now? I’m on a generic version for $12 a month. I’m alive because of this system. No corporate hero here - just dumb, beautiful market competition. Keep the patents short and let the people win.

Jennifer Taylor

December 14, 2025 AT 10:00 AM

EVERYTHING IS A LIE. 🤫 The FDA? Controlled by Big Pharma. The ‘generics’? They’re made in the same factories, just repackaged. They’re literally the same pills - but now they’re ‘generic’ so they can charge you $2 and still make billions because you think you’re saving money. They’re manipulating your trust. Your insulin? Your blood pressure meds? All part of the grand switcheroo. They just want you to think you’re free. You’re not. You’re being played.

And don’t get me started on the ‘biosimilars’ - that’s just a fancy word for ‘we’re still charging you $500 but now it’s called something else.’

They’re selling you hope. And hope is the most profitable drug of all.

Shelby Ume

December 14, 2025 AT 21:09 PM

For anyone reading this who’s confused about generics: yes, they’re safe. Yes, they work. The FDA doesn’t approve them lightly - it’s a rigorous process. I’m a pharmacist, and I’ve seen patients cry when they find out their $800/month drug is now $15. That’s not a market glitch - that’s justice.

If your insurance won’t switch you, ask for a prior authorization. If your doctor says ‘it’s fine as-is,’ ask why. Sometimes it’s habit. Sometimes it’s a rebate. You deserve to know. You’re not being difficult - you’re being informed.

And if you’re scared to switch? Start with one pill. Monitor. Talk to your pharmacist. You’ve got this.

Jade Hovet

December 15, 2025 AT 21:24 PM

OMG I JUST SWITCHED TO GENERIC HUMIRA AND MY CO-PAY DROPPED FROM $450 TO $20 😭😭😭 THANK YOU GENERIC DRUGS!! I’M CRYING RIGHT NOW 😭💖

My mom’s been on it for 12 years and we thought we’d never afford it again. My pharmacist just handed me the box like it was nothing. I didn’t even have to ask! She said ‘it’s automatic now’ - thank you, thank you, thank you!! 🙏💙

nithin Kuntumadugu

December 16, 2025 AT 21:00 PM

lol u think this is about patients? nah. this is about china and india making pills for pennies and selling them to usa. american pharma is dead. we’re just importing cheap drugs like we import toys. the real story? the usa is becoming a third-world pharmacy market. and the elites? they’re laughing all the way to the bank. 🤡

also, ozempic generics? they’ll never come. big pharma owns the fda. and the fda owns your liver. 💀

Rawlson King

December 18, 2025 AT 17:37 PM

Let’s be clear: the system is broken, but not because of patents. It’s broken because we allow corporations to treat healthcare like a casino. The fact that a $10 pill can save someone’s life while the original cost $850 isn’t a triumph - it’s an indictment. We don’t need more generics. We need price controls. And we need to stop pretending this is a free market when it’s really a rigged game.

Yatendra S

December 19, 2025 AT 15:47 PM

There is a metaphysical layer here, beyond economics. The patent system was never meant to be a weapon of survival. It was conceived as a social contract - reward innovation, then release the knowledge. But now, the contract is inverted: we pay for monopoly, then beg for access. The drug is no longer a medicine - it is a sacrament, withheld until the price is right. And who decides the price? Not the sick. Not the healer. The shareholder.

We have forgotten that healing is not a commodity. We have turned the body into a balance sheet.

Himmat Singh

December 21, 2025 AT 09:25 AM

It is imperative to note that the empirical data presented in the JAMA Health Forum study is statistically significant and robustly controlled for confounding variables. The variance in price elasticity across jurisdictions is not attributable to regulatory arbitrage, but rather to structural differences in healthcare financing mechanisms. Furthermore, the assertion regarding patent thickets is substantiated by the U.S. Patent and Trademark Office’s own database, which reveals an average of 12.7 secondary patents per blockbuster drug between 2010 and 2023. This is not exploitation - it is legal strategy, and it is entirely within the bounds of statutory law. Reform must be legislative, not emotional.

Michael Gardner

December 12, 2025 AT 15:28 PM

Yeah right, like generics are some magical solution. I’ve seen people get generic Eliquis and have heart palpitations. The bioequivalence? Total myth. They’re not the same, they just have the same active ingredient. The fillers, the coating, the release profile - all different. You think your body doesn’t notice? Wake up.